Last month, former members of HSBC and St. James’ Place Wealth Management announced an AI agent as part of their leading product line.

This multifaceted, privacy-centric AI financial agent, named Finley AI, sparked a lot of interest within the fintech community.

It’s clear why. Finley AI is one of the first finance-focused AI agents.

The press release announcing this noted that Finley AI is designed to significantly enhance client experiences and interactions. It would do this by offering scalable, on-demand engagement on a scale that human employees cannot match.

The icing on the cake were the masterminds behind Finley AI. These were figures supported by leading AI giants, including Microsoft, Google, and NVIDIA.

Elemi Atigolo, Ex-HSBC and St. James’s Place Wealth Manager and co-founder of Finley AI has even gone on record to state:

“If in the early 2000’s every firm needed a website and in 2008 every fintech company needed an app, we firmly believe that every company by 2025 will need an AI agent.”

That’s a bold claim.

But let’s backtrack for a minute and understand why this announcement was relevant for financial institutions and the AI industry in general.

Why is there such a huge demand for AI agents such as Finley AI?

Finley promises a new standard in AI for finance. It prioritizes privacy and security through strict PII redaction and financial protocols. Its advanced conversational AI offers empathetic, nuanced client interactions. The reasoning behind it is clear – offer human-level conversations and support for customers.

Developed with guidance from the UK’s Financial Conduct Authority (FCA), it is also extremely trustworthy and adheres to stringent regulatory and compliance frameworks.

If you are a CFO or CEO reading this blog and wondering if the addition of technology similar to Finley AI can truly make a difference in your organization, this article is especially directed towards you.

Here, we’ll demystify what autonomous AI agents are, their capabilities, and their operational mechanisms. And most importantly, how you can get started with AI agents.

Table of Content

- What are AI Agents?

- The Role of Autonomous AI Agents In Finance

- How Can Businesses Benefit From AI Agents?

- Insights For CFOs Exploring AI Agents

- The Future Of AI Agents in Finance

What are AI Agents?

AI Agents are computer programs that can act on their own to achieve specific goals

Former Computer Science Professor at Stanford University, John McCarthy, once said, “Artificial intelligence is the science of making machines do things that would require intelligence if done by humans.

What is the biggest difference that separates human intelligence from machines right now?

The ability to make decisions.

AI agents are here to change that.

They are autonomous programs designed to make decisions and perform tasks based on their environment, inputs, and specific objectives. Therefore, they possess the capability to think, adapt, and act independently.

Another interesting fact about them is that – they excel in unpredictable environments, utilizing their adaptability and learning prowess.

These agents can proficiently navigate the web, interact with various applications, analyze massive data sets, and conduct transactions, all while continually refining their methods based on feedback and results.

Case Study- Transforming Vendor Agreement Processing with LLMs

Types of AI Agents

Here is a quick breakdown of the different AI agents that are popularly used across industries:

| AI Agent Type |

Description |

| Simple Reflex Agents |

Operating on condition-action rules, these agents respond directly to immediate perceptions. Ideal for straightforward environments, their simplicity limits them in complex scenarios. |

| Model-based Reflex Agents |

Equipped with an internal world model, they track environmental aspects beyond immediate perception. This capability enables better adaptability in partially observable environments. |

| Goal-based Agents |

These agents anticipate future action consequences, making decisions to achieve specific goals. Their foresight is beneficial for complex decision-making tasks. |

| Utility-based Agents |

They evaluate state desirability using utility functions, aiming not just to achieve goals but to maximize performance. This approach is crucial in scenarios with multiple possible actions or outcomes. |

| Learning Agents |

These agents evolve their performance over time from experiences, making them ideal in dynamic environments where adaptability is key, such as continuously refining customer preference understanding. |

| Multi-Agent Systems (MAS) |

Involving multiple agents working towards common or individual goals, MAS is pivotal in complex tasks requiring coordination, like supply chain management. |

| Hierarchical Agents |

Structured in layers, where higher-level agents guide lower ones, they suit large-scale systems needing task breakdown and multi-level management. |

The Role of Autonomous AI Agents In Finance

AI Agents are increasingly being used in the finance industry to improve employee productivity and automate cumbersome processes

In the finance sector, the demand for AI is steadily growing.

Recent studies show that 37% of consumers have already benefited from financial assistance provided by AI-powered chatbots.

An impressive 86% of financial institution CEOs believe AI will become indispensable in their organizations.

Case Study- Optimizing Logistics Reporting and Analytics

The impact is tangible: AI has slashed false positives in fraud alerts by 60%, boosted customer satisfaction by 20%, and 70% of employees report enhanced job satisfaction due to AI integration.

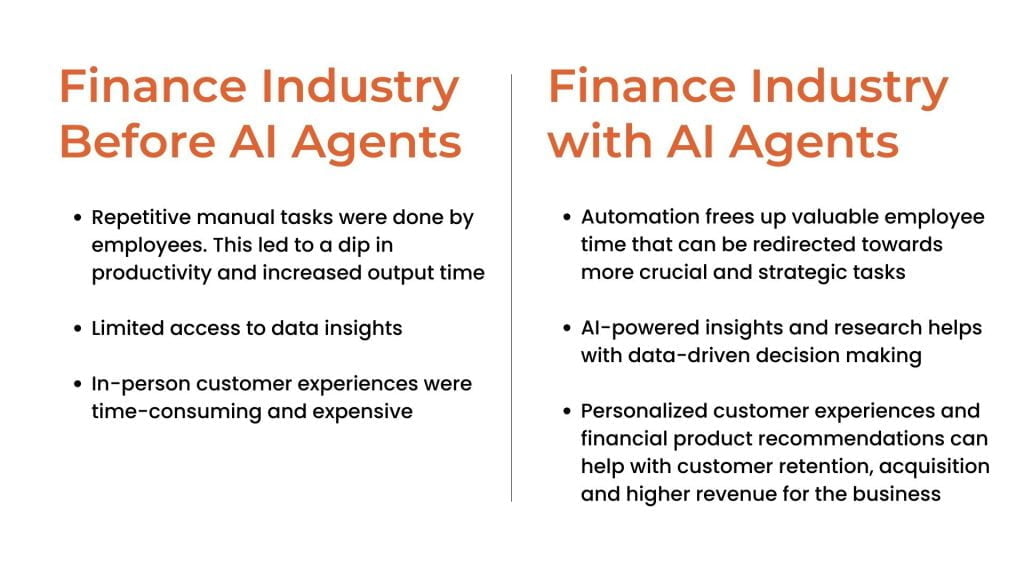

But AI in finance goes beyond just figures. So, what exactly can autonomous AI agents achieve in finance?

- Data Collection and Analysis: These agents are adept at gathering, cleaning, and integrating vast amounts of data from diverse sources like ERP and CRM systems, social media, and market data. They’re not just data processors; they’re insightful analysts, generating forecasts and recommendations that are pivotal for strategic decision-making.

- Process Automation and Optimization: Autonomous AI agents excel at automating and optimizing routine, repetitive processes—think invoice processing, reconciliation, reporting, and compliance. They’re not just about efficiency; they also skillfully handle exceptions, errors, and anomalies, continuously improving the processes they oversee.

- Decision-Making and Execution: These agents are more than just assistants; they’re decision-makers. From budget allocation and cash management to risk and investment management, they make and execute complex decisions based on predefined rules or learned models. Moreover, they can elucidate their decisions and actions, ensuring transparency and accountability.

- Collaboration and Communication: The capabilities of these AI agents extend to collaboration and communication across various functions, departments, and organizations. They serve as a nexus of interaction, providing feedback, suggestions, and guidance, enhancing the collective intelligence of the financial ecosystem.

How Can Businesses Benefit From AI Agents?

IBM was one of the first organizations to begin research on AI development

Let’s go back in time and examine the rise of a few organizations that have been instrumental in the development of AI technologies.

IBM’s journey began in the 1950s with the IBM 704 computer. In the 1960s, they developed the first AI program for solving algebra problems and later created “Deep Blue,” the chess-playing computer that defeated Garry Kasparov in 1997.

The Massachusetts Institute of Technology (MIT) has contributed largely to the development of AI, from the 1960s’ Project MAC and the creation of the natural language processing system SHRDLU to later advances in machine learning and neural networks.

SRI International: Originally the Stanford Research Institute, SRI has been pivotal in AI and robotics since the 1960s. Their achievements include the first autonomous mobile robot and the Shakey robot, a beacon in mobile AI. SRI’s advancements in speech recognition and natural language processing in the 1980s and 1990s have paved the way for today’s businesses to integrate AI into customer service and operational efficiency.

Can you identify a common factor uniting these organizations under one umbrella?

They’re all successful, renowned, and leading organizations.

Hence, it will be useful to acknowledge one thing – AI puts you on the map. And it will continue to do so as it gets better with each passing year.

Let’s See What AI Agents Can Unlock for Your Company

Improved Efficiency through Automation

AI agents excel at automating routine tasks like data entry, scheduling, and customer inquiries, which traditionally consume considerable human resources and time. This automation allows for the reallocation of human resources to more strategic activities, boosting overall productivity and fostering innovation.

Personalized Customer Experiences and Product Recommendations

AI agents stand out in their ability to deliver personalized customer experiences. By analyzing individual customer data and preferences, they can tailor recommendations and services, enhancing customer satisfaction, loyalty, and repeat business.

Highly Scalable and Efficient

Inherently scalable, AI agents can handle increasing workloads without proportional increases in resources or infrastructure. This attribute is invaluable during business peaks, product launches, or market expansions, ensuring efficiency and responsiveness.

24/7 Availability in Customer Service

Operating 24/7 without breaks or downtime, AI agents provide continuous service, which is crucial in today’s market. This constant availability means immediate response to customer queries, enhancing the customer experience and satisfaction.

Cost Savings with Reduction in Labor Costs

The adoption of AI agents leads to substantial cost reductions by minimizing the need for a large workforce for routine tasks. This reduction in labor costs, coupled with process optimization, translates into long-term operational savings.

Data-driven Insights Backed by AI-powered Analysis

Capable of processing large volumes of data, AI agents furnish businesses with critical insights into customer behavior, market trends, and operational efficiencies. These insights enable more informed decision-making, strategy tailoring, and a competitive edge.

Insights For CFOs Exploring AI Agents

AI will lead to new heights for many financial services businesses. The key to achieving that will rest on the proper implementation and utilization of AI

There’s a very utilitarian quote from the former CEO of General Electric, Jack Welch – “Change before you have to.”

When it comes to business, change is inevitable.

But there is one thing a CEO or a CFO can do: stay prepared.

Here are three mindset shifts that C-level management can embody for utilizing and moving ahead with AI agents:

Embrace Experimentation: CFOs and CEOs should adopt an experimental approach, exploring new technologies through small-scale pilots or proofs of concept. This strategy allows for rapid learning, quick failure, and the successful scaling of effective solutions.

Value Autonomous Finance as a Partner: Rather than perceiving AI as a threat, CFOs and CEOs should view it as a collaborator that enhances human capabilities. This perspective fosters a culture of trust and empowerment, integrating the strengths of both humans and machines.

Advocate for AI Technology: Proactive advocacy for AI technology adoption is essential. C-level management can educate and persuade stakeholders about the benefits and value of autonomous finance, playing a key role in driving technology adoption and integration.

The Future Of AI Agents in Finance

In finance, AI adoption is gradually increasing.

Presently, only about 32% of the finance sector uses AI for tasks like predictive analytics and speech recognition. This number is expected to grow as the sector recognizes the need to adapt or risk obsolescence, much like what happened to companies like Nokia and Blackberry.

Consider the progress already being made:

A future AI bank could operate with advanced AI agents performing various roles, a concept that’s becoming more realistic with today’s technology.

But that’s not all.

Entire companies can hypothetically be run with AI agents one day.

The role of AI agents in customer experience will expand, offering more personalized and intelligent interactions. Automation will become more prevalent, especially in tasks that are repetitive and high-volume.

Generative AI is also emerging as a game-changer for the finance sector, with many companies already starting to use genAI tools for internal purposes.

One could, however, argue that this may lead to a reduction in jobs for human employees. Which is why an entire debate on the ethical use of AI persists to this date.

However, my belief is that we will adapt to the use of AI without causing significant harm to employment opportunities. That’s because every new technology in the beginning threatens to take away jobs that become obsolete; only to then offer new opportunities for individuals.

A classic example of this shift would be the rise of digital technologies, which have today replaced a lot of the older physical and traditional processes. Insurance, for example, has moved into the digital realm and now operates seamlessly online. Has this led to a major reduction in hiring for new employees? On the contrary, it led to the hiring of various IT based roles.

The growth of AI similarly may seem to cut down some jobs in the short run, but it can still offer more strategic job opportunities for individuals in the near future.

Looking ahead, I see an AI-powered future fueling the growth of financial companies.

Are you ready for this transformation?