“If I were a professional wrestler, I’d want a name that strikes fear in most people. Something like ‘The Underwriter’.”

I came across this joke last night, and while it was hilarious – the logic was on point.

In the world of insurance and finance, underwriters are incredibly important. They analyze risk profiles, conduct research on individual products, review applications, calculate premiums, and issue policies.

They make or break insurance companies.

That’s a lot of responsibility for a single role.

Historically, successful insurance companies have always had good underwriters – gatekeepers to profit—and the continued success of an insurance organization.

However, even the mighty ‘Underwriter’ has been facing challenges lately.

Customers are increasingly dissatisfied with the claims process, putting $170 billion in premiums at risk over the next five years.

On the other side of the ring, underwriters spend 40% of their valuable time on non-core tasks, potentially costing the industry $85-$160 billion in efficiency losses over the same period.

But here’s where our story takes an exciting turn.

What if we could help our underwriters perform better by letting them focus on the tasks that really mattered to them? Here’s where our new player comes into the ring – Artificial Intelligence (AI) in underwriting.

The core promise of AI is simple – rapidly and accurately process large amounts of data and draw conclusions based on it.

This completely changes the game for underwriters and insurance companies, as AI-led automation can process client and policy data swiftly, leaving underwriters and insurers to make better data-backed decisions.

But is that all that AI can do in underwriting?

Let’s dive in and explore the incredible capabilities of AI in underwriting and insurance.

The Rise Of AI – Restructuring Traditional Underwriting Process

Traditional underwriting processes are not enough to deal with the present challenges faced by the insurance industry

BCG reports that in insurance, the role of underwriters has become increasingly complex in the last decade.

“From climate change to disruptive technology,” underwriters are tasked with navigating a minefield of risks that is more intricate than ever before, claims the global consulting firm.

There’s a growing need for underwriters to embrace critical thinking, leadership, communication, specialized expertise, and business development skills.

Again, a lot of roles and responsibilities are thrown at a single role – underwriters are swamped with information and data that they cannot process by themselves.

Meanwhile, the insurance industry is facing challenges ranging from insuring emerging technologies to dealing with the growing frequency of extreme weather events, third-party litigation, and economic inflation fueled by supply chain disruptions.

This is where good underwriting is more important than ever.

The ability of a commercial insurer to select, price, and tailor risk directly impacts their profitability. Top-performing commercial insurers, those in the top quartile of the combined ratio, consistently outshine their counterparts by approximately 13 percentage points on return on equity and 7 percentage points on premium CAGR (BCG Report).

However, insurance companies today demand more than just profitability. They require seamless, personalized, and digitally-enabled customer experiences. This is in addition to the costly consequences of non-disclosure or fraudulent behavior.

This is where AI in underwriting steps into the ring as a potential solution.

Insurtech is increasingly using AI to tirelessly work in the background—ensuring security, compliance, data verification, real-time analysis, and customized premium calculations.

The result?

A formidable challenge to traditional insurance companies, with insurtech enjoying a remarkable CAGR of 20% in recent years.

This transformation is no accident.

A research paper from the University of Pennsylvania astutely predicted last year that the insurance sector would be one of the foremost beneficiaries of generative pre-trained transformer (GPT) technologies.

By now, we have broadly covered how AI in underwriting is transforming insurance. But what are some of the functions it excels at? Will it replace the jobs of underwriters? Let’s look into it in detail.

Read More – 7 Big Data Use Cases and Trends In Insurance

Also Read – Automation In Insurance: Use Cases, Benefits, and Strategies

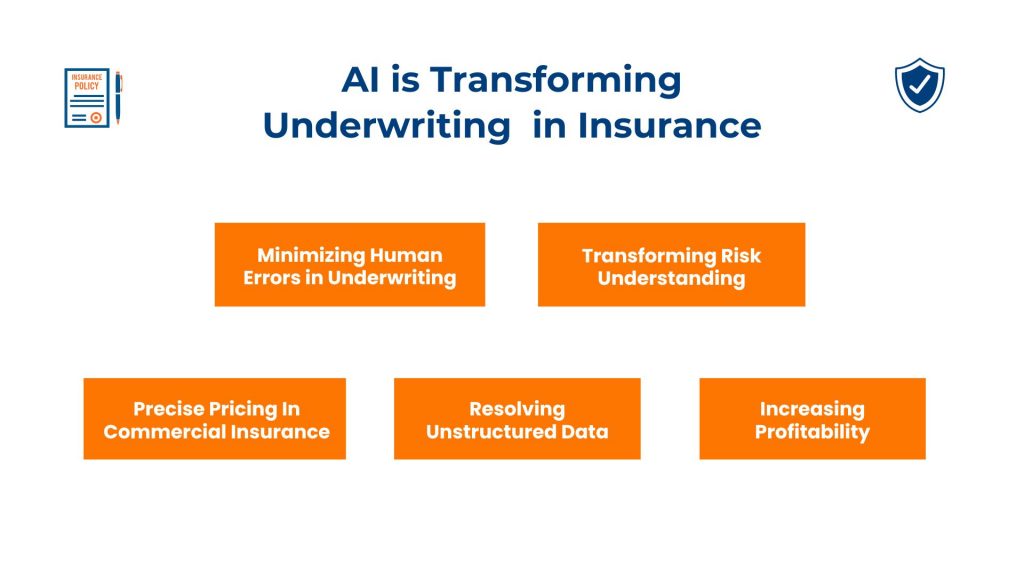

How AI in Underwriting is Transforming Insurance

1. Minimizing Human Errors in Underwriting

The saying ‘to err is human’ is a common reflection of our industries at large. Despite skilled talent, at times, even the most diligent underwriters are susceptible to oversight.

However, in the world of insurance and underwriting, where each decision carries significant financial implications, the imperative to minimize human errors is paramount.

AI excels at processing and reviewing vast datasets in various formats, dramatically reducing the potential for errors.

With AI in underwriting, human underwriters transition to ‘human-in-the-loop’ (HITL) roles within automated underwriting processes.

They analyze AI-generated outcomes, applying predefined models to make informed decisions. AI operates algorithmically, continuously learning from past errors through machine learning, ensuring speed, scalability, and effectiveness in insurance underwriting.

This shift not only minimizes costly errors but also accelerates the underwriting process, fostering industry agility and innovation.

But will this shift in insurance technology replace human underwriters?

Not at the moment.

Insurance underwriting is still a very complex process and requires careful human insight and expertise. While AI in underwriting helps speed up and automate certain processes, insurance companies still need skilled human talent to lead their underwriting.

However, with AI in underwriting processes, human underwriters can focus on complex risk assessments, secure in the knowledge that AI backs up their decisions with unparalleled accuracy.

Read More – Telematics in Insurance: How It Works and Benefits You

2. AI Transforming Risk Understanding in Underwriting

AI in underwriting helps streamline risk assessment by combining different technologies

Traditional underwriting often grapples with the complexity of diverse data sources.

Key data sources include credit reports, income and employment data, bank statements, public records, and even social media and online behavior.

- Credit reports, provided by bureaus like Experian and Equifax, offer credit histories and payment records.

- Income and employment data determine a borrower’s financial stability.

- Bank statements reveal spending habits and financial stability.

- Public records, such as bankruptcies, expose financial history.

- Emerging data sources like social media and online behavior provide insight into a borrower’s lifestyle and risk aversion.

Manually gathering, processing, and analyzing this data can be a painstaking process, prone to inefficiencies and inaccuracies.

On the other hand, AI-powered systems streamline this process, leveraging big data, machine learning, and predictive analytics.

This is where AI in underwriting shines as the solution to a longstanding challenge in the insurance industry: accurate risk evaluations.

By harnessing big data, machine learning, and predictive analytics, AI streamlines due diligence processes, minimizing time and maximizing accuracy. This transformative power redefines underwriting, enabling insurers to make informed decisions efficiently.

3. AI-Powered Precise Pricing In Commercial Insurance

In commercial insurance, pricing has long been a challenge.

A case study by McKinsey highlighted a disconcerting reality: a small business owner seeking commercial property and casualty insurance received coverage quotes that varied by a staggering 233% from five different carriers for nearly identical risks.

This pricing inefficiency is not an isolated incident, as evidenced by major players like AIG grappling with daily losses exceeding $75 million from their commercial lines alone.

The root cause? Inadequate risk profiling leads to substantial financial setbacks.

In such a landscape, AI in underwriting offers unparalleled risk visibility and rectifies these pricing inefficiencies.

AI-powered underwriters meticulously assess risk profiles and recommend optimal pricing options and coverage terms.

The impact? Fair and precise pricing while also mitigating losses that arise when risks are inadequately captured.

4. Using AI And NLP in Insurance to Resolve Unstructured Data

NLP helps to consolidate unstructured data for underwriters

A 2021 McKinsey report projects that AI adoption in the insurance industry could bolster productivity and slash operational expenses by up to 40% by 2030.

Within the ongoing trend of AI innovation, Natural Language Processing (NLP) emerges as a powerful solution for insurers.

NLP, a facet of AI, empowers computers to decipher and glean meaning from human language, playing a pivotal role in classifying text and extracting essential insights from textual and transcribed audio data.

But how exactly does NLP solve challenges for insurers?

It’s a dreaded two-letter word that has been traditionally both expensive and time-consuming for insurers—unstructured data.

Picture an insurance underwriter: a professional navigating through digitized documents, policy applications, and customer communications. In this deluge of data, maintaining consistently high levels of accuracy and efficiency is a tough task.

NLP enters the stage, adding much-needed structure to previously unstructured data sources.

Through text mining, NLP algorithms deftly go through vast data repositories, extracting vital information.

Named Entity Recognition (a NLP method) facilitates the automatic extraction of specific items, such as names, dates, locations, and medical diagnoses.

Moreover, when coupled with Optical Character Recognition (OCR), NLP possesses the capability to decipher handwritten text, seamlessly integrating diverse data sources, from doctors’ handwritten notes to on-site accident reports, into the underwriter’s arsenal.

This is a big game-changer for insurance companies, as it allows for an automated system that compiles digital and physical data and helps create unified data for insurers to review.

According to IBM, knowledge workers spend up to 30% of their workday searching for essential information. With NLP and AI in underwriting, insurers stand to save up to 30% of their time daily, which in turn can lead to higher productivity.

Consider claims management, for instance.

NLP and text classification can automate the labor-intensive claims process by extracting crucial details, categorizing claim types, and analyzing claim text for key terms that signal the cause of loss.

5. Increasing Profitability With AI-Powered Underwriting

Maintaining profitability can be challenging for insurance companies as it hinges on various factors.

Escalating loss ratios, converting quotes, and resource allocation are challenges that insurance companies have to resolve.

Fortunately, AI in underwriting can help mitigate many such issues.

It enhances underwriting efficiency by boosting quote conversion rates, lowering loss ratios, analyzing better risk profiles, and optimizing resource allocation.

Furthermore, by assisting employees with AI, insurance companies also stand to gain better workforce productivity, which can lead to better company performance.

While the implementation of AI may seem expensive in the short-term, its long-term effects can save companies millions of dollars in the form of reduced operational expenses, better efficiency, and increased profits.

A PwC report predicts a massive surge in the market size of frontier technologies such as big data and AI, from $350 billion in 2018 to a staggering $3.2 trillion by 2025. This represents a tenfold increase in just seven years, highlighting the rapid growth and potential of these technologies.

The Challenges and Ethics in Implementing AI in Underwriting

AI implementation may be a challenge for insurance companies that have not worked with AI in the past

While AI in underwriting offers numerous benefits when compared to traditional processes, it comes with inherent challenges.

- Data Privacy Concerns: Firstly, AI introduces data privacy concerns as it involves the collection and analysis of vast personal information, potentially leading to unauthorized access or misuse. The use of synthetic data could be an effective way to resolve data privacy concerns.

- Data Biases: Insurers must diligently address algorithmic biases in AI systems. Research indicates potential prejudices against certain social groups, necessitating careful algorithm development and monitoring. This is where insurance companies must evaluate their data sources and ensure their data is free of biases.

- Implementation Cost: Cost considerations also come into play, as insurers must weigh the expenses of AI implementation against its advantages. While long-term cost savings of enterprise AI implementation are great in the long-run, insurance companies (especially the smaller ones) should carefully analyze the cost vs. long term benefits.

- Ethical Considerations: The question of ethics looms large in AI underwriting. Caution must be exercised to avoid discrimination against specific groups, and transparency is vital. Applicants should have avenues for appealing underwriting decisions.

All the above challenges are easily solvable for insurance companies if they work with the right AI implementation partners.

In my experience, AI implementation can have enormous benefits for companies.

My team and I recently helped a leading Insurance company in the USA with AI implementation, which helped our client reduce their risk exposure by 25%. That translates to millions of dollars in savings in the long-term.

Another insurance client of ours benefited from our collaboration through a fully automated AI-based data mapping solution.

It helped them optimize their workforce by 38% and gave them 94% accuracy in accurate data mapping – a much higher percentage than their traditional data mapping process.

While there still remain challenges in the use of AI in underwriting and insurance, the positives far outweigh the cons. AI is here to stay, and the insurance industry stands to benefit the most from this innovative technology.

The Future Of Insurance Rests on AI

In this decade, AI’s role in insurance underwriting is set to become more prevalent.

The push towards digital and remote models, accelerated by the COVID-19 pandemic, is leading to the adoption of end-to-end automation in underwriting processes.

This shift is leading insurance companies to move away from legacy systems towards more agile, integrated approaches that emphasize customer-centric design and user experience.

The utilization of diverse and new data sources, such as prescription histories and credit-based insurance scores, is creating new milestones in risk assessment processes.

Advanced AI techniques like machine learning and natural language processing are also becoming integral to these platforms, culminating in an insurance system that is data-driven and AI-powered.

In the coming decade, we can expect so much more from AI-led underwriting.

Fast and efficient risk profiling, one-to-one AI-powered customer service, easy customized policy creation, and hassle-free automated payments and profile checks.

AI in underwriting is clearly making the lives of underwriters and insurance companies easier by enabling a transition from traditional insurance processes.

What was once considered a hindrance for insurers (manual tasks like data checks and customer profiling) is swiftly transitioning into automated processes that are highly accurate.

And it’s only going to get better from here on!