Financial institutions have long been wary of adopting new technologies. Banks took decades to shift banking infrastructure and payments online, and even then, they encountered various challenges with security and efficiency for years to come.

With technologies like hyperautomation (a blend of AI and automation) now revamping entire industries such as healthcare and manufacturing, can banks and insurance companies benefit in the same way?

It absolutely can – and the preliminary results are already impressive. Gartner emphasizes that hyperautomation is no longer an optional approach. It is a critical necessity for organizational survival and is on its way to becoming a $600 billion industry.

As Michael Hyatt quoted, “Automation means solving a problem once, then putting the solution on autopilot.” With hyperautomation, institutions can create intelligent automated solutions that can work without human intervention – a boon for industries as comprehensive as banking and insurance.

In this article, we discuss the benefits of hyperautomation for insurance and banking institutions, as well as some case studies and industry examples to highlight this growing trend.

Table of Contents

- What is Hyperautomation?

- Key Hyperautomation Technologies

- How can Hyperautomation Benefit Insurance Companies and Banks?

- Benefits of Hyperautomation for Banks and Insurance Companies

- Partner with Kanerika for your Hyperautomation Journey

- FAQs

What is Hyperautomation?

Hyperautomation is an innovative approach to business process optimization.

The goal of hyperautomation is to automate complex business processes from end-to-end. This enables organizations to achieve unprecedented efficiency.

Hyperautomation services blend various technologies like AI, ML, RPA, modern ERP systems, and low-code/no-code tools to automate business processes.

Examples of hyperautomation are all around us, from banking to retail.

The process of hyperautomation involves three key steps:

- Discover and Analyze: Process mining and task mining identify repetitive, rule-based tasks for automation.

- Automate and Orchestrate: A mix of solutions (from single-technology for basic tasks to multi-technology for complex ones), including RPA based hyperautomation, AI, and system integration.

- Monitor and Optimize: Solutions that ensure ongoing monitoring, operational smoothness, and enhancement opportunities using analytics and benchmarking.

Let’s understand the key technologies that are driving the trend of hyperautomation among industries.

Also Read – Automation In Insurance: Use Cases, Benefits, and Strategies

Key Hyperautomation Technologies

Hyperautomation services require the simultaneous application of multiple technologies. It is a synthesis of several emerging domains.

- Robotic Process Automation (RPA): RPA involves using software robots to automate repetitive, rule-based tasks.

- Artificial Intelligence (AI) and Machine Learning (ML): Hyperautomation services leverage AI and ML to enable systems. They learn from data, make decisions, and continuously improve.

- Process Mining: Process mining involves analyzing event logs to discover inefficiencies. This helps identify inefficiencies and areas for improvement.

- Low-Code Development: Hyperautomation often involves the use of low-code or no-code development platforms. It encourages non-technical users to contribute to automation efforts through simple inputs.

How can Hyperautomation Benefit Insurance Companies and Banks?

The question is why invest in hyperautomation services? What are the tangible benefits of hyperautomation that make it such a key technology to adopt? The answer is layered.

The finance industry has always maintained a traditional approach to adopting new technologies. There are multiple layers of checks and balances as well as audits in place to prevent any errors from creeping into the process.

However, over the past decade, banks have learned that risk management is better done through the use of software.

Using hyperautomation technologies allows banks and insurance companies to adopt a layered multi-technological setup that uses the best of AI, automation, and low-code interfaces to drive business processes.

In the next section, we shall be taking a closer look at the multiple benefits of hyperautomation and use cases that are benefiting banks and insurance companies.

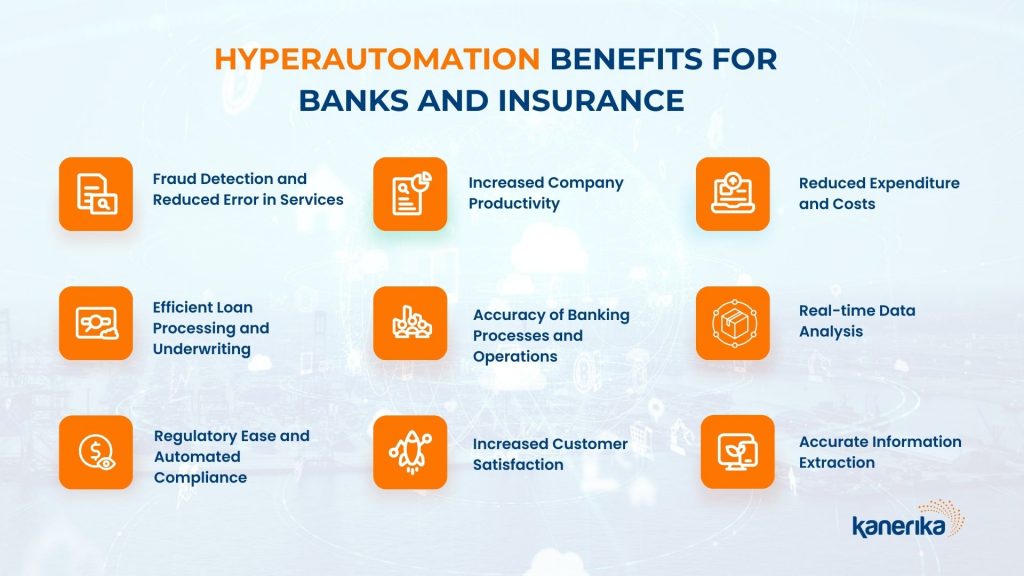

Benefits of Hyperautomation for Banks and Insurance Companies

Fraud Detection

Hyperautomation services are vital for fraud detection and prevention in financial institutions. It offers real-time analysis of large datasets to identify patterns indicative of fraudulent activities.

Algorithms can trigger alerts, enabling financial institutions to prevent fraud. Waylay’s cloud-native fraud monitoring solution, processes up to 20 million transactions per day with a response time of less than 1 ms per transaction – a remarkable figure!

In crucial processes such as Know Your Customer (KYC), hyperautomation enhances fraud detection, which is crucial in confirming a customer’s identity. Hyperautomation achieves this through a blend of AI, machine learning, and automation.

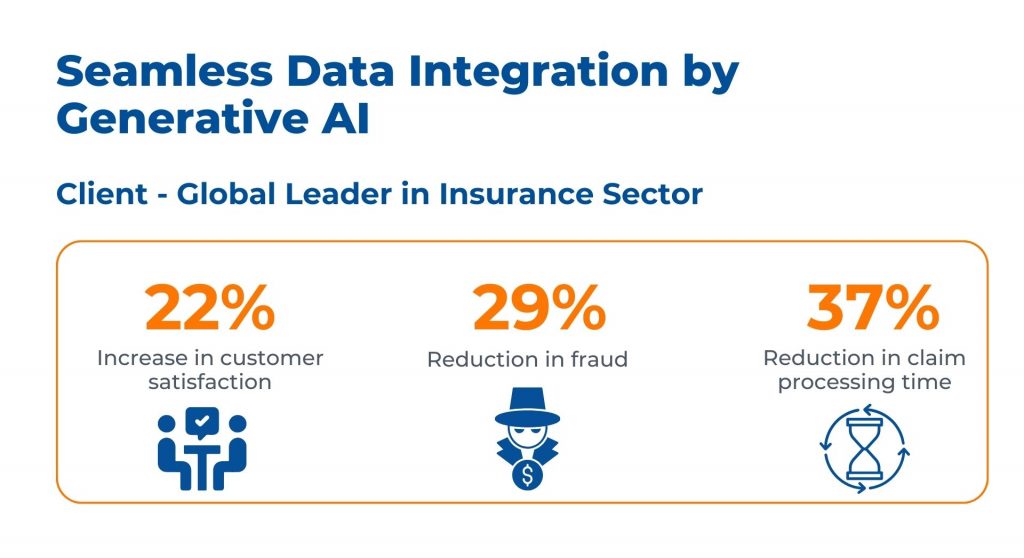

Kanerika Case Study: Enhancing Data Integration with Generative AI

A global leader in the insurance sector faced significant challenges in data integration, hindering operational efficiency and decision-making processes.

Challenges:

- Manual Integration: Tedious manual processes led to errors, delays, and compliance risks

- Limited Insights: Existing solutions hindered decision-making and customer experience

- Emerging Data Complexity: Wearable devices and electronic health records added integration complexity

Solution:

- Automated Extraction with Kafka: Enabled efficient data consolidation, reducing errors

- Standardized Data Using Talend: Ensured consistency and compatibility organization-wide

- Gen AI Models (TensorFlow, PyTorch): Minimized manual efforts, aligning and integrating data seamlessly

Technology Used:

- TensorFlow and PyTorch | Kafka | Talend

Outcome:

- Customer Satisfaction: Achieved a 22% increase

- Fraud Reduction: Realized a 29% decrease

- Claim Processing Efficiency: Experienced a 37% reduction in processing time

More Efficient Loan Processing and Underwriting

Hyperautomation significantly enhances the efficiency of loan processing and underwriting. By automating tasks ranging from loan application to approval, it reduces processing time and improves customer experience.

Hyperautomation systems can create and follow a checklist aligned with the bank’s criteria to ensure loans applications are processed promptly.

This streamlined approach reduces the likelihood of errors, and leads to a more satisfactory experience for both the bank and its customers.

Regulatory Ease and Automated Compliance

Banks have to be attentive to complex anti money laundering laws. Hyperautomation offers substantial benefits to banks and insurance companies in this regard.

Automated systems are adept at processing vast amounts of data swiftly and accurately. This enhances the ability to detect and report suspicious activities effectively. Such efficiency not only ensures adherence to regulatory requirements but also lowers the risk of incurring financial penalties.

Through the adoption of hyperautomation, financial institutions can maintain compliance more easily. This is one of the most prevalent hyperautomation use cases in insurance and banking industry.

Increased Company Productivity

The deployment of RPA (Robotic Process Automation) significantly boosts company productivity by automating repetitive tasks.

With RPA agents or automation software managing these routine activities, human employees are freed from supervision and manual intervention. This shift allows staff to focus on more creative and strategic work.

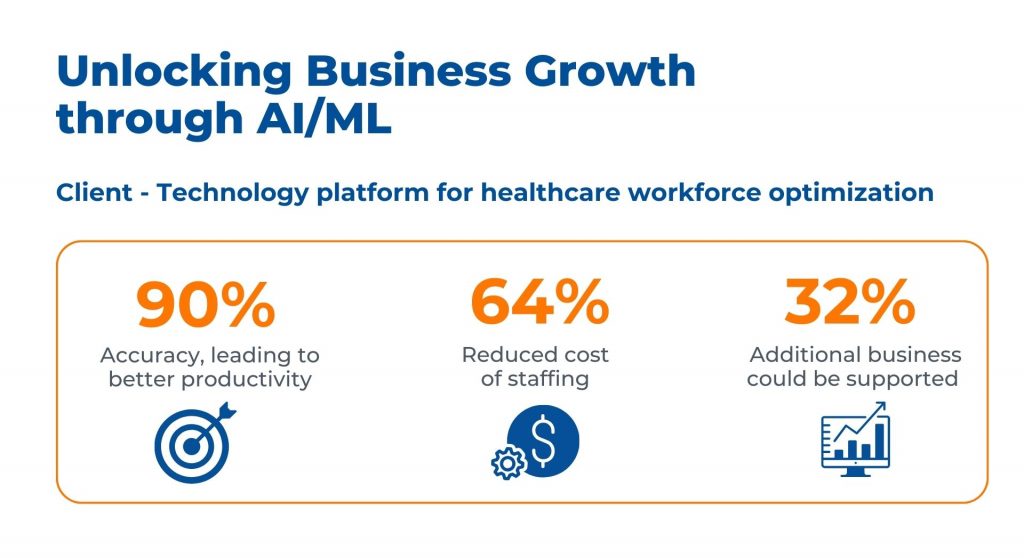

Kanerika Case Study: Healthcare Workforce Optimization with AI/ML

A healthcare technology platform faced challenges in talent shortlisting, document verification, and operational scalability.

Challenges:

- Manual Talent Shortlisting: Delays in shortlisting skilled talent impacted business growth.

- Document Verification Issues: Manual verification led to errors, compromising quality and customer satisfaction.

- Operational Scalability: Heavy reliance on operations hindered scalability and meeting customer demands.

Solutions:

- AI/ML Document Verification: Implemented AI/ML algorithms for accurate verification, streamlining operations.

- Optimized Operations: Used AI/ML to optimize headcount, reducing costs and enhancing scalability.

- Automated Onboarding with AI: Implemented AI-based onboarding, increasing productivity and supporting business growth.

Outcomes:

- Accuracy Improvement: Achieved 90% accuracy, enabling the team to accomplish more.

- Cost Reduction: Realized a 64% reduction in staffing costs.

- Increased Business Support: Supported 32% more business with fewer staff.

Technology Used:

Improved Customer Satisfaction

Hyperautomation technology contributes to improved customer satisfaction in the banking sector. By automating routine tasks, it frees up staff to focus more on customer service.

Lower level queries can be handled efficiently by automated systems. Humans can focus on solving the more complex queries. This shift allows for a more personalized and efficient customer experience.

There is no doubt at all that an enhanced level of customer service directly translates to higher growth. The following industry case study explains this:

Royal Bank of Canada (RBC) NOMI Forecast

In May 2023, The Royal Bank of Canada (RBC) announced that its NOMI Forecast, an AI-powered tool, won the Best Use of AI for Customer Experience at the 2023 Digital CX Awards.

NOMI Forecast offers clients a seven-day cash flow view, covering various transactions.

Launched in September 2021, it has been used by over 900,000 clients and has recently expanded to include bill payments and other financial activities.

Peter Tilton of RBC highlighted the role of AI in enhancing customer money management. Developed with Borealis AI, NOMI Forecast is part of RBC’s broader effort to deliver personalized financial insights and advice to clients – a winning strategy that was achieved by utilizing hyperautomation.

Accuracy of Banking Processes and Operations

Hyperautomation elevates the precision and dependability of banking processes. It ensures smoother, more reliable banking operations, bolstering both customer trust and operational efficiency.

Through automated systems, banks can efficiently manage complex calculations and extensive data processing with a high degree of accuracy. The reduction in errors increases the reliability of financial reports.

Reduced Possibility of Error in Services

Hyperautomation significantly lowers the likelihood of errors in insurance and banking services. By utilizing hyperautomation technology, businesses can ensure that suitable software and technologies are in place to detect and address issues promptly.

AI systems and image recognition software play a crucial role in rapidly verifying and rectifying errors.

Case Study: Automated Supply Chain Workflows for Logistics Company

A leading logistics company faced challenges in time-consuming quarterly releases, manual work, and new system training.

Challenges:

- Quarterly Release Challenges: Excessive time and effort spent on quarterly releases, resulting in unreliable validation.

- Manual Work and Lack of Centralization: Manual processes and lack of centralized data/info center posed risks of errors.

- Training and Attrition: New systems demanded extensive training, leading to a spike in the attrition rate.

Solutions:

- UIPath Automation: Automated supply chain workflows across multiple ERPs using UIPath for enhanced overall performance.

- Bot Orchestration: Orchestrated bots for sales order creation, purchase order generation, and fulfillment, reducing delays and errors.

- Resource Optimization: Optimized resource allocation to focus on strategic tasks, reducing operational expenses.

Outcomes:

- Resource Optimization Improvement: Achieved a 32% improvement in resource optimization.

- Process Accuracy Enhancement: Realized a 60% improvement in process accuracy.

- Error Reduction: Experienced a significant 78% reduction in errors.

Technology Used:

Reduced Expenditure and Costs

Hyperautomation in banks and financial institutions significantly reduces costs by automating complex, repetitive tasks. It streamlines operations like data processing, customer service, and regulatory compliance.

This efficiency cuts down on the need for extensive manual labor, leading to substantial savings in workforce-related expenses.

Industry Example: Nvidia’s AI Implementation in Financial Services Study (2023)

Nvidia’s study highlights the significant potential of AI in transforming financial services, making it a critical tool for cost efficiency and improved customer engagement.

Background: Nvidia, a leading chipmaker, conducted a comprehensive study on the use of AI in financial services.

Objective: To understand how AI can reduce costs and improve the customer experience in the financial sector.

Methodology: A survey of 500 global financial professionals.

Findings:

- Cost Reduction: 36% of respondents achieved over 10% annual cost reduction using AI.

- Enhanced Customer Experience: 46% observed an improvement in customer service due to AI implementation.

Real-time Data Analysis

Hyperautomation empowers financial institutions to harness real-time data analysis, revolutionizing decision-making and risk management.

This technology blends AI and machine learning to monitor financial transactions, offering instant insights into current trends and predictive analysis for future outcomes. For banks, this means enhanced detection and prevention of fraudulent activities through AI-driven predictive models.

Insurance companies benefit similarly, using hyperautomation to craft personalized policies based on a comprehensive analysis of varied data factors such as age of client and past history. This lets insurers craft better policies for their clients that are more data-relevant.

Accurate Information Extraction

RPA hyperautomation, together with AI and machine learning, can extract accurate information from the customer data stored in banking systems.

Additionally, in cases of errors or incomplete fields in documents, automated processing works with third-party databases to fill gaps. It makes Accounts Receivable and Accounts Payable processes more accurate. This integration contributes to more effective and reliable banking operations.

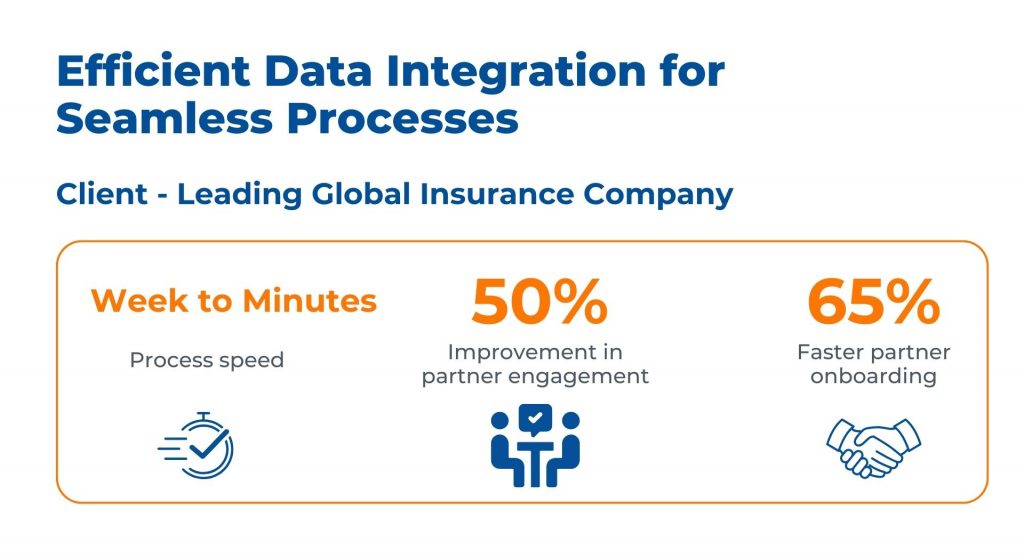

Kanerika Case Study: Streamlining Claim Processing

A global insurance leader faced inefficiencies in claim processing due to manual Excel-based handling of files from 500+ partners.

Challenges:

- Manual Claim Handling: Delays and errors in processing claims from 500+ partners

- Data Standardization: Lack of standardized formats and insights led to inefficiencies

- Reactive Processes: Manual issue resolution caused delays and hindered profitability

Solution:

- Insights via Power BI: Utilized Power BI for standardized data formats, improving decision-making.

- Proactive Notifications: Enabled proactive notifications, reducing delays in issue resolution.

Technology Used:

Outcomes:

- Speed Improvement: Reduced claim processing time from weeks to minutes.

- Partner Engagement: Achieved a 50% improvement.

- Faster Onboarding: Realized a 65% reduction in partner onboarding time.

Partner with Kanerika for your Hyperautomation Journey

Hyperautomation is leading a critical evolution in how businesses, especially in the banking and insurance sectors, operate in 2023. Its impact is profound, spanning IT operations, customer service, fraud detection, and regulatory compliance.

Hyperautomation’s blend of AI, ML, RPA, and other advanced technologies has catalyzed efficiency, agility, and innovation for businesses. Which in turn, makes this technology an essential tool for organizational survival in a rapidly evolving market.

Yet, the full potential of hyperautomation is realized only with precise implementation.

This is where Kanerika’s expertise becomes invaluable. With a decade of experience in automation, robotics, and AI, Kanerika is at the forefront of the hyperautomation revolution. Kanerika specializes in crafting value-investment, highly customized solutions that cater to the unique challenges and goals of each business.

Contact Kanerika’s experts today to embark on a journey toward a more efficient, agile, and hyperautomated future.

FAQs

What is the primary benefit of Hyperautomation?

The primary benefit of hyperautomation lies in its ability to enhance organizational efficiency and agility by automating end-to-end business processes. By integrating technologies like AI, ML, RPA, and low-code platforms, hyperautomation enables organizations to streamline operations, reduce errors, and free up valuable human resources for more complex tasks.

What are the pros and cons of hyperautomation?

Pros:Increased Efficiency: Automates repetitive tasks, reducing time and errors.Enhanced Decision Making: AI and ML offer predictive insights, improving strategy and planning.Cost Reduction: Reduces labor costs and operational expenses over time.Scalability: Easily scales operations to meet growing business demands.Cons:Initial Investment: Can be costly to implement initially.Complexity: Requires expertise to integrate different technologies effectively.Dependency: Increased reliance on technology may pose risks if systems fail.Workforce Impact: Can lead to job displacement in certain roles.

What is the impact of Hyperautomation?

Hyperautomation significantly impacts businesses by driving digital transformation, enhancing customer experiences, and ensuring more agile and resilient operations. It enables real-time data analysis, better fraud detection in financial services, and more personalized service offerings, ultimately leading to improved customer satisfaction and operational excellence.

How is Hyperautomation different from automation?

While traditional automation focuses on automating individual tasks, hyperautomation extends this concept to automate complex, end-to-end business processes. It combines multiple technologies like AI, ML, RPA, and advanced analytics, whereas traditional automation typically relies on singular, rule-based technologies.

What are some examples of Hyperautomation?

Examples include:Fraud Detection Systems: Using AI and ML to analyze transaction data in real-time.Automated Loan Processing: Integrating RPA with AI to streamline loan approvals.Regulatory Compliance: Using AI to monitor and report on compliance issues automatically.Personalized Insurance Policies: Leveraging data analytics for tailored policy offerings.

Why is hyperautomation key to digital transformation?

Hyperautomation is key to digital transformation as it accelerates the adoption of digital processes, enhances data-driven decision-making, and fosters innovation. By automating complex processes and integrating various digital technologies, it helps businesses stay competitive in a rapidly evolving digital landscape.

Is Hyperautomation intelligent automation?

Yes, hyperautomation is a form of intelligent automation. It not only automates tasks but also brings intelligence to these processes through the use of AI, ML, and data analytics. This intelligence allows for more complex, decision-making tasks to be automated and continually improved over time.