As the insurance industry navigates the aftermath of the COVID-19 pandemic and the economic consequences of the conflict between Russia and Ukraine, the sector has shown remarkable adaptability and resilience. Investments in technology and talent have paid off in the form of improved systems and capabilities. However, rising inflation, high-interest rates, and the threat of recession pose new challenges to insurance companies. Can there be an elegant solution to assist insurers in their ability to maximize the potential of their customer data? Business Intelligence for insurance has the potential to be that answer.

BI and Its Impact on Decision-Making

Business Intelligence, or BI as it is known in brief, refers to technologies, applications, and processes that transform raw data into useful information. BI aims to help organizations make better and more informed business decisions by providing real-time data and analytics.

It is easier to identify opportunities, secure threats, track performance metrics, and forecast future trends using BI tools. BI helps executives make informed decisions about resource allocation, product development, and market strategy and assists the management in identifying areas for improvement and helps make changes that drive growth and increase profitability.

5 Ways Insurance Companies Benefit from Business Intelligence

BI can play a crucial role in many different areas in the insurance sector. Here, we explore the five top ways in which BI can benefit insurance companies:

-

Improved Customer Experience

In 2023, prioritizing customer centricity remains crucial for insurers, as emphasized at the ITC and Connected Claims conferences. Understanding and catering to policyholders’ preferences and needs is key, as they expect personalized interactions. Fortunately, advancements in data-based technology and optimized business intelligence tools facilitate the hyper-personalization of customer data, allowing insurers to move towards a data-driven, customer-centric approach rather than a product-centered one.

Such as, a CEO can have an immediate answer to the question, “What amount has been paid out for the death of individuals between 45-70, in the years 2020-2022? How much was received as a premium, and was there a nominal profit?” This enables companies to have answers to specific case scenarios and customize their products keeping unique market scenarios and trends in mind.

Insurance fraud encompasses a wide range of unethical actions committed by individuals seeking undue advantage from insurance companies.

Fraud is a significant challenge for insurance companies. Globally, the loss runs into billions of dollars.

In the US alone, the loss due to non-health insurance fraud amounts to $40 billion. This vast loss inflates premiums by an estimated $400-700.

BI can help detect and prevent fraudulent activities by analyzing patterns. Insurance companies can use large amounts of data from multiple sources to identify anomalies that indicate fraudulent behavior.

This information can be used to implement appropriate measures to prevent fraud.

-

Increased Operational Efficiency

Insurance companies can streamline operations and reduce the workforce by implementing Business Intelligence tools. Through analysis of insurance claims, an insurance company can identify where they are losing money and bring about changes to improve the process.

In addition, BI helps insurance companies automate manual processes. The elimination of humans eradicates errors and enhances the accuracy of data. This is especially true for zero-code or no-code automated tools that can handle vast amounts of data and convert them to usable information through a simple interface. This, in turn, can lead to reduced costs, improved productivity, and better customer satisfaction.

BI allows insurance companies to analyze large amounts of data and identify trends and patterns. Management and business owners can then use the new insights to make informed decisions regarding resource allocation and product development.

Note that insurance businesses not only receive premiums but also invest the same. BI tool-based investing goes far beyond predicting bond yields and candle chart movements. Business Intelligence tools can identify fresh investment opportunities using financial statements, economic indicators, and news articles.

-

Improved Collaboration and Communication

Disparate data resources make it difficult for insurance companies to create accurate reports and actionable analytics. Around 67% of data is five days old by the time it is loaded, which leads to delayed processing & increased man-hours.

Business Intelligence tools can offer a central data repository. The data can be made accessible in various ways, e.g. Interactive dashboards, reports, and graphs.

This information can be shared with diverse organisational stakeholders, including executives, managers, and front-line employees. The improvement in collaboration and communication can help resolve issues more quickly, enabling them to stay compliant with regulations and protect against fraud and other risks.

Data Transformation with FLIP – The Zero-Code Solution for Insurance Companies

Increasing research indicates that having data alone is not enough. The data has to offer actionable insights that can improve company revenue and maximize the potential of good data. Here are two statistics that continue to plague the insurance industry and lead to loss of revenue and operational inefficiency for insurance companies:

- A survey by Experian found that 83% of insurance companies struggled with data quality issues.

- A study by IBM found that data quality issues, such as incomplete or inaccurate data, can result in a loss of up to 20% of revenue for insurance companies.

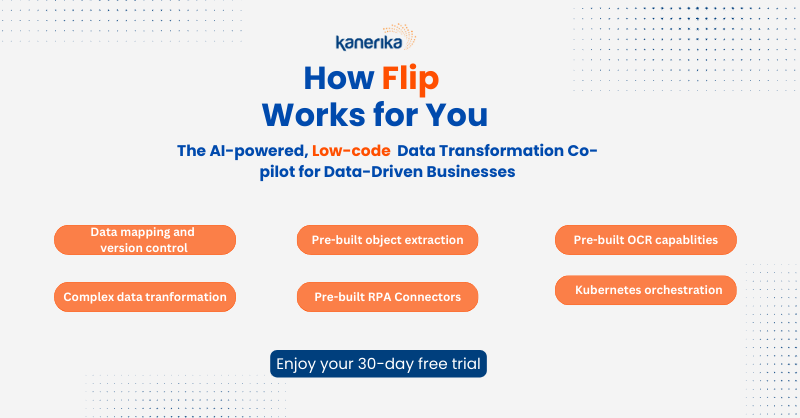

Keeping these and many other alarming statistics in mind, Kanerika has created FLIP. This zero-code business intelligence tool has been designed to meet the insurance sector’s unique needs, helping you to manage large and complex datasets effectively while retaining important data trends to improve customer satisfaction and operational efficiency.

One of the most significant advantages of FLIP is its zero-code implementation. With our intuitive interface, you can easily connect to your data sources, map and transform data, and churn out informative and actionable reports. Whether you’re dealing with structured data from databases, unstructured data from Excel spreadsheets, or anything in between, FLIP makes it easy to integrate and keep your data up-to-date.

Why wait? Sign up for FLIP today and start harnessing the power of data like never before!

Frequently Asked Questions

How can Business Intelligence assist insurance companies in identifying fresh investment opportunities?

BI tools can identify fresh investment opportunities using financial statements, economic indicators, and news articles, going beyond predicting bond yields and candle chart movements.

How does Business Intelligence assist insurance companies in risk assessment and pricing strategies?

BI helps insurance companies assess risk by analyzing historical data, market trends, and external factors. This information informs pricing strategies, allowing insurers to offer competitive rates while managing risk effectively.

How can insurance companies measure the ROI (Return on Investment) of their Business Intelligence implementations?

ROI in BI can be measured by tracking key performance indicators (KPIs) related to cost savings, revenue growth, customer satisfaction, and operational efficiency improvements resulting from BI initiatives.

How can insurance companies ensure the ethical use of data when implementing Business Intelligence solutions?

Ethical data use in BI involves data privacy compliance, transparent data collection, and responsible handling of customer information. Insurance companies should establish data governance policies and adhere to relevant regulations to maintain ethical standards.

How does Business Intelligence assist insurance companies in improving customer experience and personalizing interactions with policyholders?

BI enables insurance companies to hyper-personalize customer data, catering to policyholders' preferences and needs. It allows insurers to answer specific questions about policy payouts and premiums quickly, customize products based on market trends, and shift toward a data-driven, customer-centric approach.

How does Business Intelligence support better decision making for insurance companies, including investment decisions?

BI allows insurance companies to analyze vast amounts of data, identify trends, and gain insights into resource allocation and product development. It also aids in identifying fresh investment opportunities by analyzing financial statements, economic indicators, and news articles.

What are the key trends and future prospects of Business Intelligence in the insurance sector?

Business Intelligence in insurance is likely to continue evolving with advancements in data analytics, AI, and machine learning. Trends include predictive analytics for risk assessment and automation of claims processing for faster and more accurate services.

Recommend any specific Business Intelligence tools or resources tailored to the insurance industry?

Popular BI tools like Tableau, Power BI, and QlikView can be customized for insurance companies. Additionally, industry-specific publications and webinars can provide insights into BI applications in insurance.

What specific benefits does Business Intelligence offer to insurance companies facing economic uncertainties and inflation?

BI helps insurance companies by enabling them to identify opportunities, manage risks, and make data-driven decisions in a rapidly changing economic environment. It assists in optimizing resource allocation, product development, and market strategy.

What role can Business Intelligence play in assisting insurers in customizing their products and services based on market conditions?

BI provides insurers with market insights, enabling them to tailor products and services to meet changing customer demands and stay competitive in evolving market conditions.